In the ever-evolving world of trading, understanding ones own trading personality can be a game-changer. Enter simulated trading—a powerful tool that goes beyond charts and figures, delving deep into the psyche of aspiring traders.

What can you glean from a virtual environment, where every decision is stripped of real-world consequences? The lessons learned in this digital arena are profound, revealing not just strategies and market trends, but the emotional nuances that govern your trading behaviors.

Are you prone to impulsive decisions, or do you thrive on meticulous planning? Do you embrace risk, or hesitate at the brink? Simulated trading offers a unique mirror, reflecting traits and tendencies that can significantly influence your financial journey.

This exploration invites you to embark on a journey of self-discovery, armed with the insights to refine your approach, temper your instincts, and ultimately, enhance your trading prowess.

Discovering Your Trading Personality

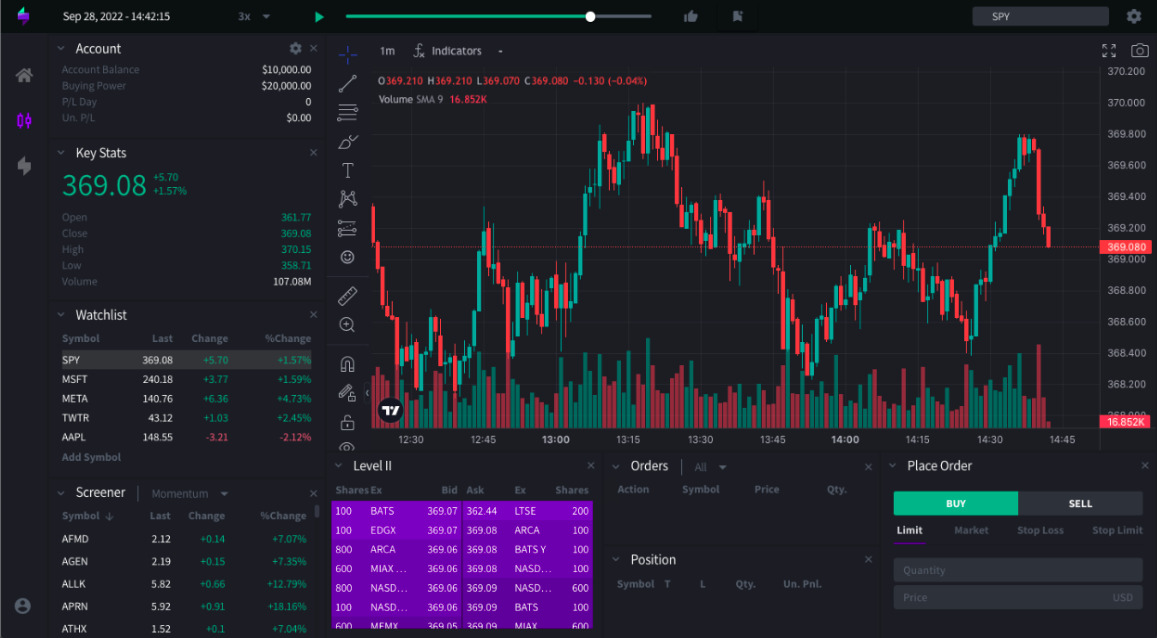

Understanding your trading personality is a journey of self-discovery, revealing the intricate interplay between your emotional responses and decision-making processes in the realm of trading. Imagine navigating through the virtual landscapes of simulated trading, where tools like a replay chart free feature allow you to revisit and analyze past trades, turning each trade into a mirror reflecting your strengths and weaknesses, your patience and impulsiveness.

Are you the meticulous planner, analyzing every market trend with painstaking detail, or perhaps the bold risk-taker, driven by gut instincts and adrenaline? As you engage with simulated environments, you confront scenarios that challenge your biases and highlight your innate tendencies.

This unique experience not only sharpens your analytical skills but also illuminates your personal trading style, paving the way for a more informed and confident approach in the real market. Whether you thrive on swift trades or deliberate strategies, recognizing these nuances can transform your trading journey from mere speculation into a well-defined path that aligns with your true self.

How Simulated Trading Reveals Your Strengths and Weaknesses

Simulated trading serves as a revealing mirror that reflects both your strengths and weaknesses as a trader, offering invaluable insights into your decision-making processes and emotional responses. As you maneuver through a series of market scenarios, your instincts come into play—do you cling to a losing position out of pride, or do you cut your losses swiftly, showcasing resilience? Each trade, whether a triumph or a setback, acts as a lesson, peeling back the layers of your trading personality. You might discover an unyielding analytical prowess in crunching numbers, or perhaps notice an impulsive streak that disrupts your strategy when the heat of the market intensifies.

Moreover, the feedback loop of wins and losses allows you to identify patterns in your behavior—are you overly cautious, or does overconfidence creep in after a string of successes? In this dynamic environment, the complexities of your trading tendencies unfurl, enabling you to hone your skills and rectify detrimental habits, all in the pursuit of becoming a more astute trader.

Risk Tolerance: Are You a Risk-Taker or Risk-Averse?

Risk tolerance plays a pivotal role in shaping your trading personality, acting as the compass that guides your decisions in the turbulent waters of the financial markets. Are you the type who dives headfirst into the unknown, motivated by the thrill of potential high rewards, or do you prefer to cautiously navigate the waves, weighing every possibility before making a move? Simulated trading serves as a fascinating playground, allowing individuals to explore their innate proclivities without the immediate stakes of real money.

Here, the distinction between risk-takers and the risk-averse can become starkly clear. You might find yourself questioning whether the adrenaline rush of a bold decision outweighs the comfort of a measured approach.

Are you more inclined to chase after that elusive winning streak, or do you meticulously analyze each trade, seeking the safest route to financial growth? Engaging in simulations offers invaluable insights, revealing not just your trading strategies but also the underlying psychology that drives your decision-making process.

Conclusion

In conclusion, simulated trading offers invaluable insights into your trading personality, allowing you to experiment with strategies, manage risk, and reflect on your emotional responses in a risk-free environment. By utilizing tools like a replay chart free, traders can revisit past market scenarios, honing their decision-making skills and gaining a deeper understanding of their behaviors under pressure.

Ultimately, this practice not only builds confidence but also enhances self-awareness, making you better equipped to navigate the complexities of real-world trading. Embracing simulated trading as a learning tool paves the way for more informed, disciplined, and successful trading in the future.